AP Capital provides short-term financing for commercial real estate all over the US. Loans for International transactions start at $5 million. As innovators, we offer you vast choices, better flexibility of terms and more competitive options to bring your project to completion, providing construction to permanent financing up to 90% of the total cost of the project. These loans are assumable and non recourse.

AP Capital has consistently provided our diverse clients with

customized solutions to enable them to reach their investment goals and providing accessibility to the entire Real Estate Commercial investment.

If you are in seek of financing for projects outside the U.S. AP Capital has the ability to arrange financing. We provide access to competitive capital and solutions. We facilitate the funding necessary to complete international transactions including but not limited to; infrastructure, manufacturing, hospitality, tourism, and technology. We are able to arrange financing for U.S. and non-U.S. companies seeking to expand. We will entertain both private sector and public sector projects.

Our comprehensive approach offers funding for your geothermal, solar or natural gas project, as well as providing access to the critical resources for completion-high quality suppliers and consultants. No matter how unique the transaction or how large the project, for either the public or the private sector, inquire about our overseas opportunities. Tap into the power AP Capital’s global funding capabilities.

See Preliminary Loan Information Package for submission information

International Finance:

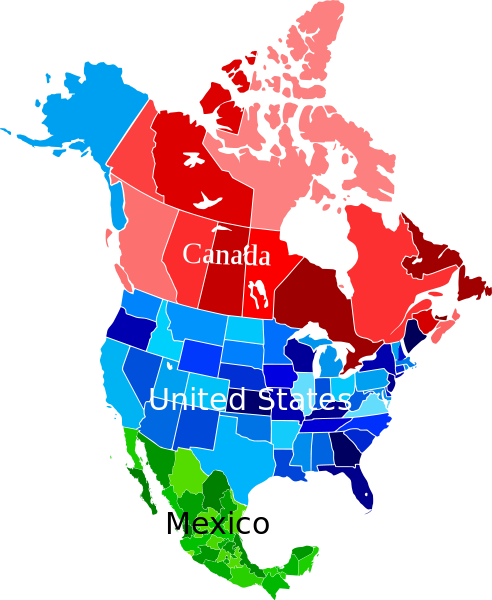

Canada and Mexico  Commercial Real Estate Lending Program

Foreclosures, NODs, Bankruptcy, and Bad Credit Foreign national ITIN Number-Individual Taxpayer Types of Properties Restaurants Office Building/Office Condo Multi-Family/Apartments Hotels/Motels Shopping Centers Medical Office Health Care Assisted Living Bank Owned Properties Churches Mixed-Use Including Office, Retail, Industrial, multifamily, mini-storage Gas Stations Grocery Stores Industrial Property Retail, Self Storage, Lite Industrial Warehouse, Class A/B Mobile Home Parks Fully Entitled Lands Preferred Marinas  Call today for your Loan Application or click here for the qualification form. Commercial Loan REQUEST  .jpg)

Commercial Loan Amounts From 5M - 50M+ |

©2016 AP Capital Investments (480) 765-7351

All Rights Reserved. AP Capital declares that all the content information is for his intention purpose and confidential

exempt from disclosure. All copyrights: All trademarks and registered trademarks are the property of AP Capital as respective owners.